Internal Audit

The organization of internal audit

- The internal audit unit of our company is subordinate to the Board of Directors. Additionally, that unit has the positions for auditors in sufficient numbers and with sufficient competence, based on the size of our company, business conditions, management needs, and regulations from other applicable laws, to perform internal audit engagements in our company.

- The qualifications of internal auditors should meet the qualifications required by law, and internal auditors should continue to undergo professional training until the meet the requirement for the number of training hours. Additionally, the company should disclose data such as the names, age, education, experience, years of service, and the training received, of its internal auditors, according to the format on the website designated by securities regulators before the end of January each year.

- The Audit Committee and the Board of Directors approved the revision of the general rules of the "Internal Audit System" on November 3th, 2020. Relevant regulations such as audit and salary management are handled. Except that the appointment and removal of the internal audit supervisor should be approved by the Audit Committee and submitted to the Board of Directors for resolution, the other items are signed by the audit supervisor to the chairman for approval." Relevant regulations have been disclosed in the internal audit section on the company's website.

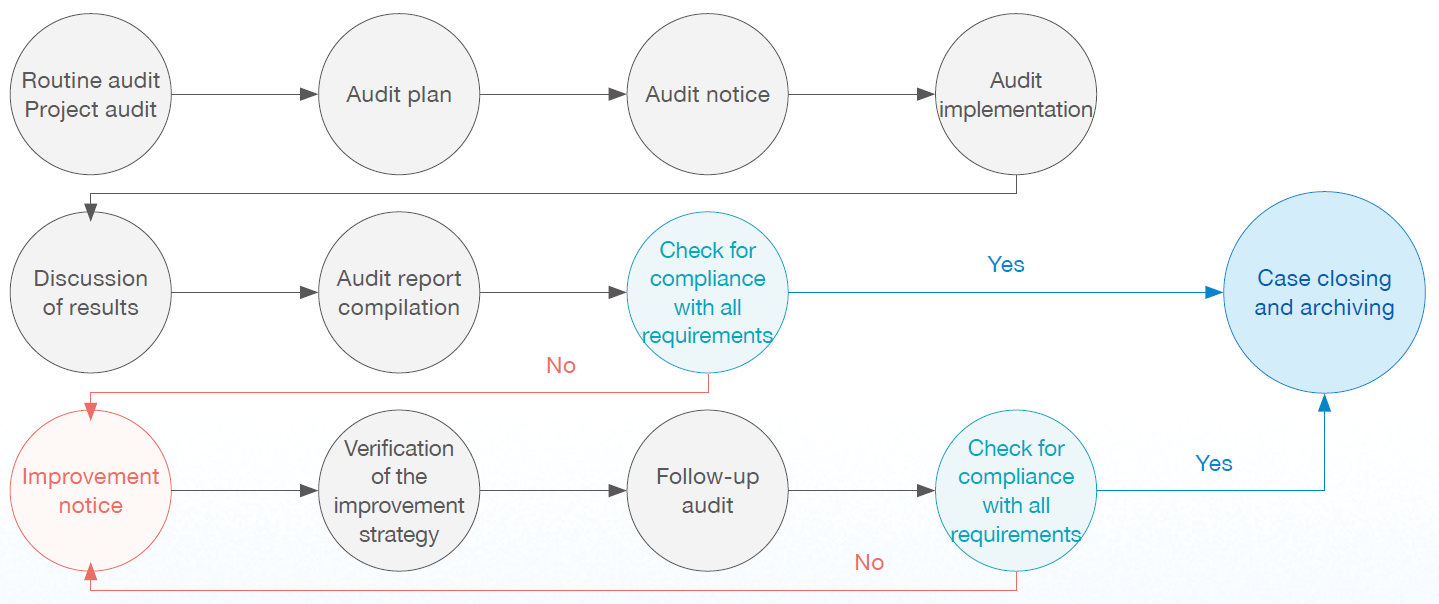

The operation of internal audit

- The processing of our company’s internal audit matters is completely governed by regulations of this procedure and the Guidelines for Establishment of Internal Control Systems by Public Companies codified by the Securities and Futures Commission, Ministry of Finance.

- Internal auditors should execute all internal audit engagements with independence.

- The internal audit unit of our company should draft annual audit plans according to statutory requirements and the outcome of risk evaluation. It should also define the items that should be audited each month/quarter and seek board approval for these items, with which the internal auditors can inspect the internal control regulations and functions of the company. Internal auditors can then compile an audit report along with the work paper and relevant data.

- If internal auditors encounter findings through the audit, they should ask the units audited to provide improvement measures and disclose such measures in the audit report. They should also follow up on the deficiencies discovered in the audit and the exception items.

- Aside from reporting the condition of audit operations to Audit Committee, the Chief Internal Auditor should present the report at the Board meeting.

- The internal audit unit of our company will perform disclosure and declaration on the condition of execution of the annual audit plan from the previous year before the end of each February on the website designated by securities regulators pursuant to regulations.

- The internal audit unit of our company will perform disclosure and declaration on internal control deficiencies discovered from the internal audit in the previous year and the condition of improvements on exceptions before the end of each May on the website designated by securities regulators pursuant to regulations.

- The internal audit unit of our company will perform disclosure and declaration on the audit plan of the following year before the end of each December on the website designated by securities regulators pursuant to regulations.